Digital Transformation in Rural Areas: Tokat Gaziosmanpaşa University Raises Awareness Against Fraud

April 26, 2025

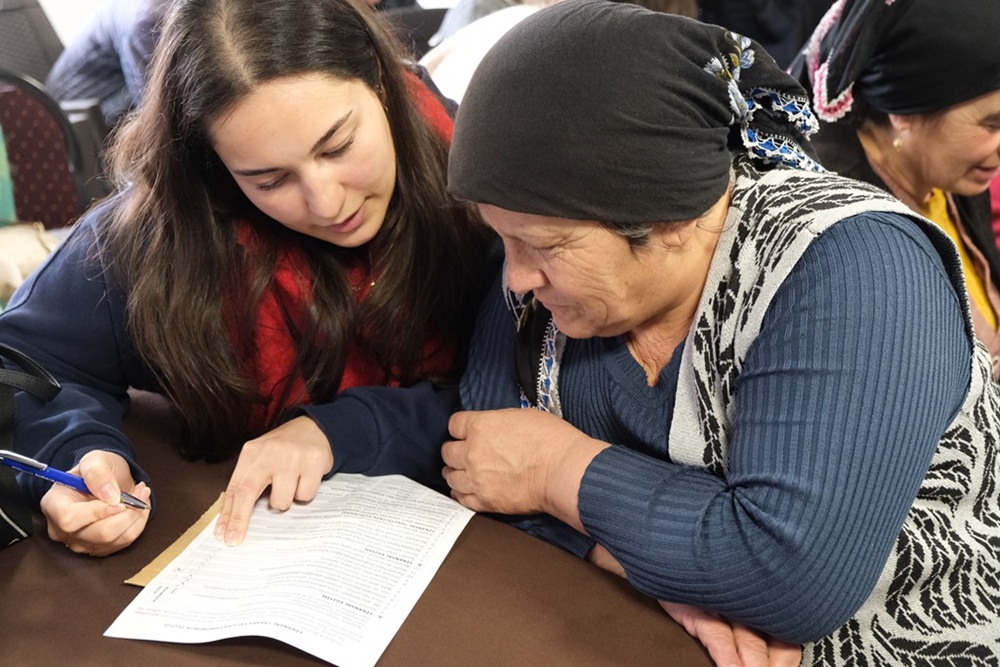

Tokat Gaziosmanpaşa University continues its seminars to raise awareness of citizens throughout the province of Tokat and in rural areas within the scope of the project “Key for Rural Development: Increasing Digital Financial Literacy Competencies”.

The project, carried out in cooperation with Tokat Gaziosmanpaşa University and Tokat Provincial Gendarmerie Command, aims to raise awareness of citizens living in rural areas about digital financial literacy and to raise awareness against financial frauds.

Prof. Mihriban Coşkun Arslan, one of the project coordinators, stated that students from the departments of finance and business administration are also involved in the seminars and said, “With our project, we aim to increase the digital financial literacy competencies of people, to make safer transactions in the digital world and to be careful against financial frauds.”

CoHE President Erol Özvar stated that they attach importance to universities serving the country with projects that benefit their regions and society by going off-campus in addition to their education and training activities.

Özvar advised students and academics not to stay at universities but to increase their knowledge, skills and competencies outside the university and said, “We encourage and support our universities to develop projects for the needs of their regions. I congratulate our professors and students who took part in the project of Tokat Gaziosmanpaşa University, which is a good example of scientific communication.”

In the seminars that will last for six months in the districts and villages of Tokat, academicians will come together with citizens and discuss topics such as digital financial management, tax awareness and safe internet use. Within the scope of the project, the seminars are designed to increase financial awareness in rural areas and protect citizens against fraud risks.

The seminars raise awareness on digital banking transactions, e-government account usage and fraudulent investment risks.